Tax Form 941 For 2024

Tax Form 941 For 2024. Several lines, some of which were. The new tax regime, which has low tax rates but fewer exemptions and deductions, will be the default tax regime.

Schedule b, report of tax liability for semiweekly schedule depositors; 2024 payroll taxes & form 941:

Schedule B, Report Of Tax Liability For Semiweekly Schedule Depositors;

As this form is filed quarterly,.

How To File And Important Due Dates.

Schedule b, report of tax liability for semiweekly schedule depositors;.

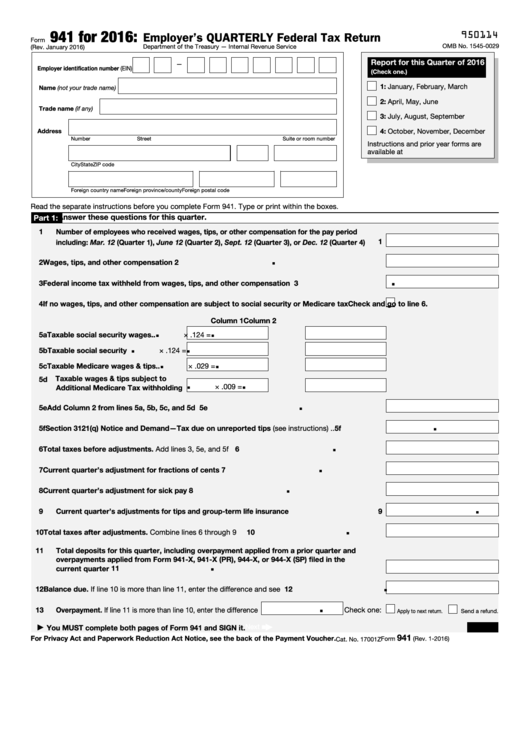

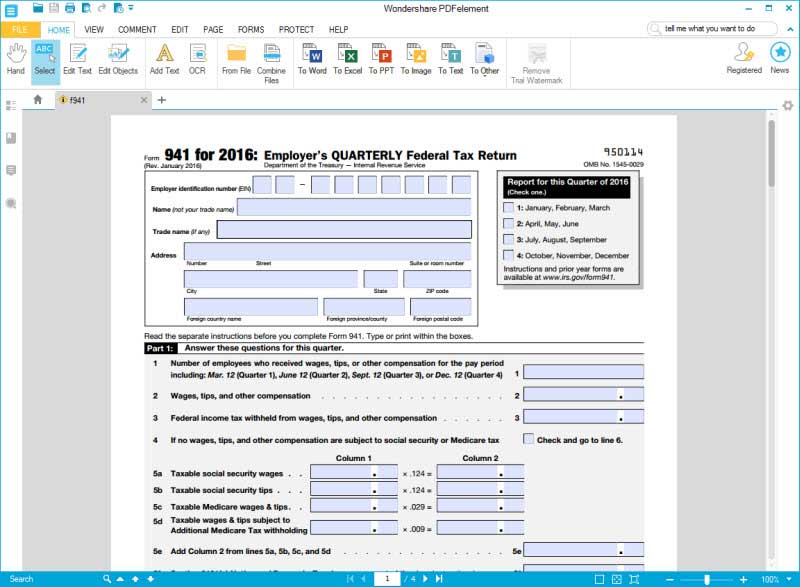

The Draft Form 941, Employer’s Quarterly Federal Tax Return, Has A March 2024 Revision Date And Only 18 Lines, Instead Of 28.

Images References :

Source: www.pdffiller.com

Source: www.pdffiller.com

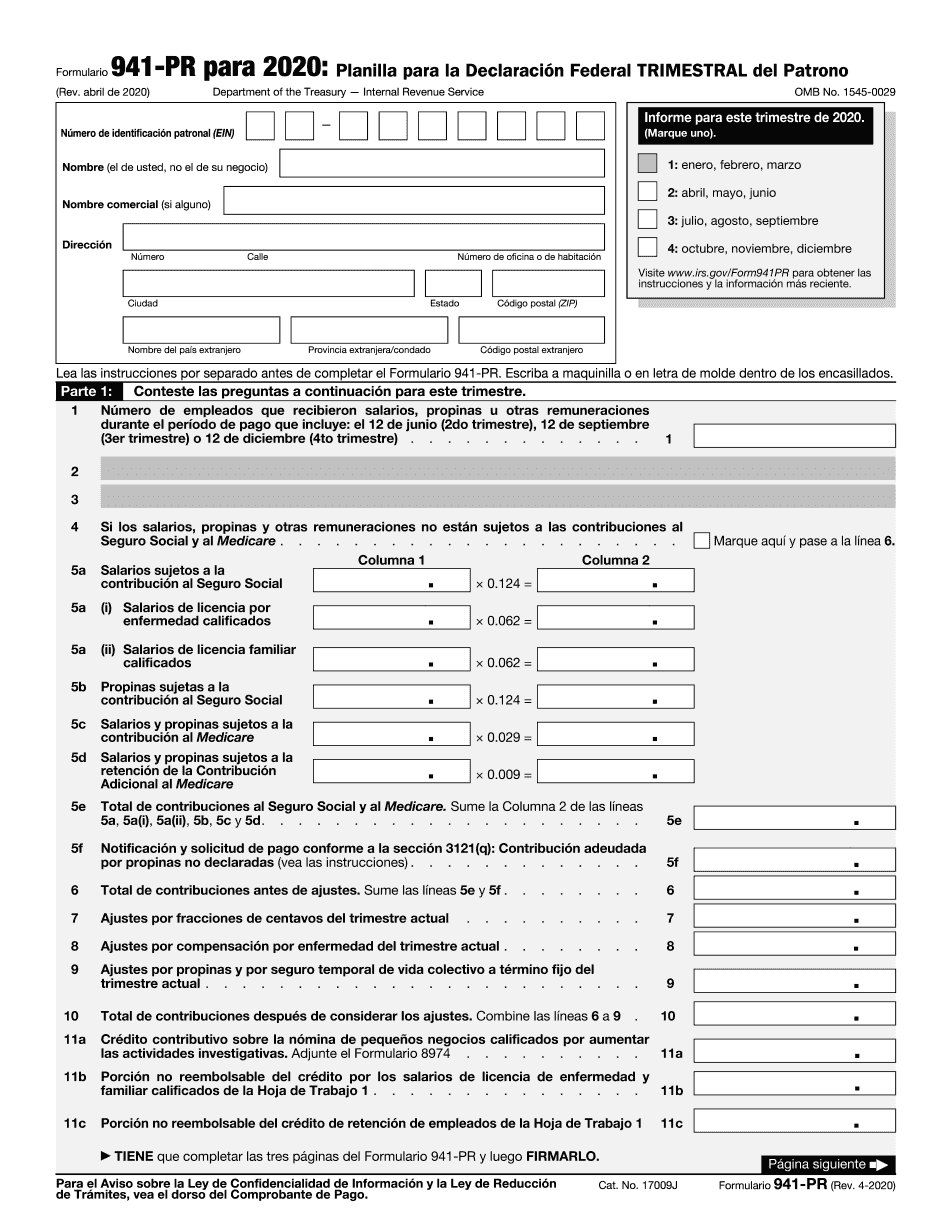

941 Form 2020 Pdf Fill Online, Printable, Fillable, Blank pdfFiller, Washington — the internal revenue service today urged taxpayers to take important actions now to help them file their 2023 federal income tax return next. 941 for q1 2024 was listed for 01/27/2024 — 01/30/2024 (q1) and due 02/02/2024.

Source: printableformsfree.com

Source: printableformsfree.com

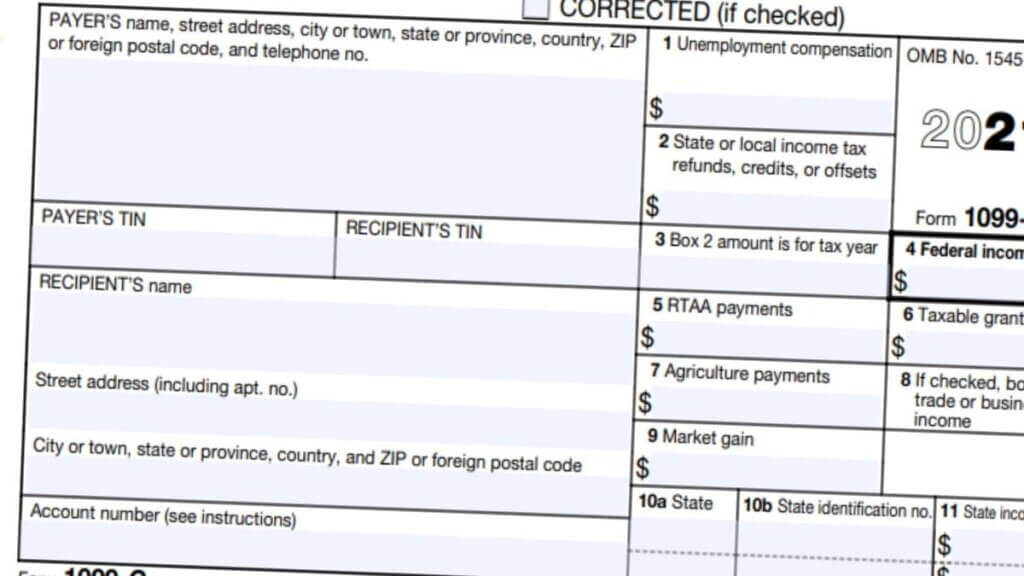

Printable 941 Form Schedule B Printable Forms Free Online, Ever wonder how soon after payroll are federal taxes due?. The form 941 deadlines for 2024 are as follows:

Source: printableformsfree.com

Source: printableformsfree.com

Free Download Fillable Form 941 Printable Forms Free Online, The irs may adjust the form throughout the year to reflect new rules and laws. Schedule b, report of tax liability for semiweekly schedule depositors;.

Source: www.zrivo.com

Source: www.zrivo.com

Form 941 For 2023, Form 941 updates for q1, 2024 and beyond. As we enter a new tax year, it’s crucial to stay informed about any changes to form 941.

Source: www.justgoing.se

Source: www.justgoing.se

Form 941 Payment Voucher Unclefed justgoing 2020, The irs released the 2024 form 941, employer’s quarterly federal tax return; Several lines, some of which were.

Source: www.irs.gov

Source: www.irs.gov

3.11.13 Employment Tax Returns Internal Revenue Service, Changes to form 941 and its schedules’ draft. Why is federal taxes (941/943/944) showing in qb that this quarterly tax is for:

Source: www.deskera.com

Source: www.deskera.com

What is the IRS Form 941?, The final release included form 941, employer’s quarterly federal tax return; Why is federal taxes (941/943/944) showing in qb that this quarterly tax is for:

Source: robbyqcarmelia.pages.dev

Source: robbyqcarmelia.pages.dev

When Is Form 941 Due 2024 Ibby Theadora, Most businesses must report and file tax returns quarterly using the irs form 941. Irs releases draft instructions for form 941, schedules.

Source: www.dochub.com

Source: www.dochub.com

941 form 2020 pdf Fill out & sign online DocHub, The final release included form 941, employer’s quarterly federal tax return; Deposit by the earlier of:

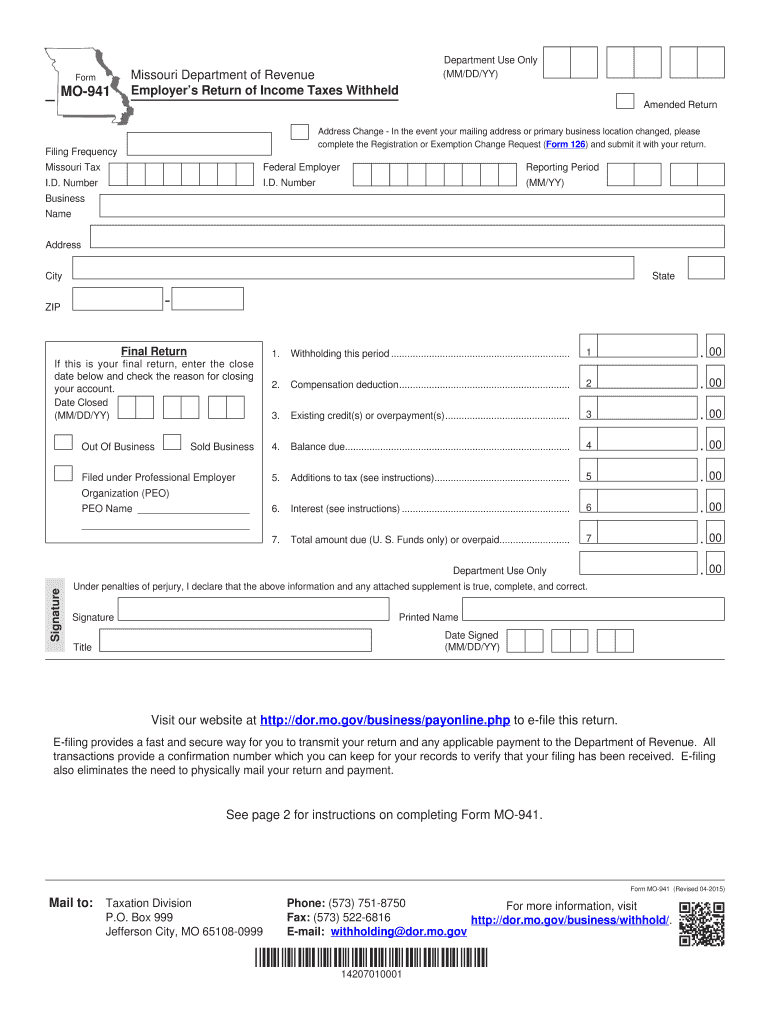

Source: www.signnow.com

Source: www.signnow.com

Missouri Revenue Form Mo 941 Fill Out and Sign Printable PDF Template, The draft form 941, employer’s quarterly federal tax return, has a march 2024 revision date and only 18 lines, instead of 28. 2024 payroll taxes & form 941:

Page Last Reviewed Or Updated:

The internal revenue service (irs) has recently released the 2024 form 941, employer’s quarterly federal tax return, along with.

This Guide Provides The Basics Of The 941 Form, Instructions To Help You Fill It Out, And Where You Can Get Help Meeting All Your Payroll Tax.

The form 941 deadlines for 2024 are as follows: