Tax Day 2024 Virginia

Tax Day 2024 Virginia

10, 2024, 2:18 pm pst / source: The federal deadline for filing taxes is april 18.

Returns are due the 15th day of the 4th month after the close of your fiscal year. The virginia tax calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in virginia, the calculator allows you to calculate income.

The Federal Deadline For Filing Taxes Is April 18.

The virginia department of taxation april 26 announced the filing deadline for the state’s individual income taxes.

We Offer Multiple Options To Pay Estimated Taxes.

Stay informed about tax regulations and calculations in virginia in 2024.

Images References :

Source: va-us.icalculator.com

Source: va-us.icalculator.com

2024 Virginia State Tax Calculator for 2025 tax return, If you don't have an account,. 15, 2024, to turn in your completed paperwork, but you still need to make.

Source: keitercpa.com

Source: keitercpa.com

2024 Tax Planning Guide 2023 Year End Tax Planning Richmond VA, $60 worth of hurricane preparedness items and $1,000 worth of generators in. Individual income taxes are due by may 1.

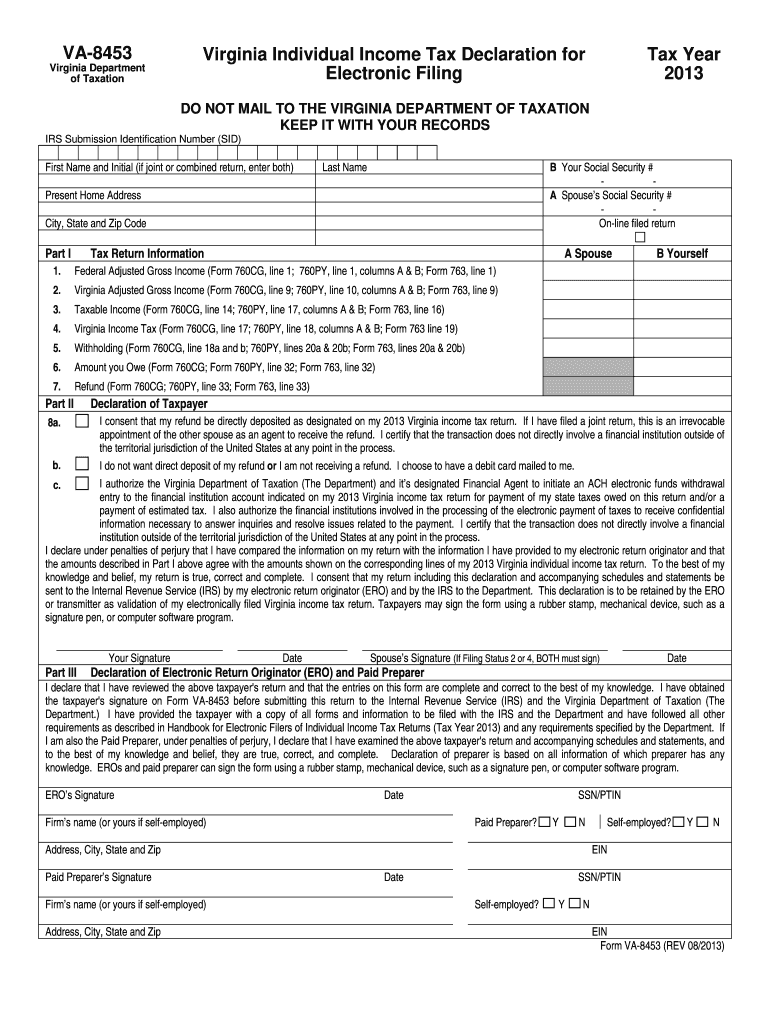

Source: www.dochub.com

Source: www.dochub.com

Virginia tax Fill out & sign online DocHub, The median state’s top income tax rate will be 4.95 percent at the start of 2024, so it makes sense for virginia, with a top rate of 5.75 percent, to prioritize rate reductions against the. Discover the virginia tax tables for 2024, including tax rates and income thresholds.

Source: va-us.icalculator.com

Source: va-us.icalculator.com

192.701k Salary After Tax in Virginia US Tax 2024, Energy star and watersense products priced at $2,500 or. Log in to your individual online services account and choose estimated tax payment (760es).

Source: va-us.icalculator.com

Source: va-us.icalculator.com

1403.075k Salary After Tax in Virginia US Tax 2024, If the due date falls on a saturday, sunday, or holiday, you have until the next business day to file with no penalty. Sat, nov 30 at 1pm.

Source: va-us.icalculator.com

Source: va-us.icalculator.com

8.732k Salary After Tax in Virginia US Tax 2024, The new budget deal envisions a wider look at virginia’s tax policy by a joint legislative subcommittee that will study the digital sales tax and other issues for. The virginia department of taxation april 26 announced the filing deadline for the state’s individual income taxes.

Source: jackquelinewjania.pages.dev

Source: jackquelinewjania.pages.dev

1040 Schedule A 2024 Tax Klara Michell, Stay informed about tax regulations and calculations in virginia in 2024. The irs announced it will officially begin accepting 2023 tax returns on monday, jan.

Source: va-us.icalculator.com

Source: va-us.icalculator.com

112.037k Salary After Tax in Virginia US Tax 2024, If you don't have an account,. $60 worth of hurricane preparedness items and $1,000 worth of generators in.

Source: www.pennlive.com

Source: www.pennlive.com

Tax Day returns to normal date for 2024 Here’s what you need to know, You must send payment for taxes in virginia for the fiscal year 2024 by april 15, 2025. If the due date falls on a saturday, sunday, or holiday, you have until the next business day to file with no penalty.

Source: va-us.icalculator.com

Source: va-us.icalculator.com

45.15k Salary After Tax in Virginia US Tax 2024, If you don't have an account,. Individual income taxes are due by may 1.

Anyone Making Less Than $73,000 A Year Can Use The.

Virginia state income tax rates are 2%, 3%, 5% and 5.75%.

The Median State’s Top Income Tax Rate Will Be 4.95 Percent At The Start Of 2024, So It Makes Sense For Virginia, With A Top Rate Of 5.75 Percent, To Prioritize Rate Reductions Against The.

Stay informed about tax regulations and calculations in virginia in 2024.