Social Security Wage Base 2024 Formulary

Social Security Wage Base 2024 Formulary. Social security wage base for 2024. The 2024 social security wage base is $168,600, up from the 2023 limit of $160,200.

The social security administration recently announced that the wage base for computing social security tax will increase to $168,600 for 2024 (up from $160,200 for 2023). Base for 2024 under the above formula, the base for 2024 shall be the 1994 base of $60,600 multiplied by the ratio of the national average wage index for 2022 to that for.

Base For 2024 Under The Above Formula, The Base For 2024 Shall Be The 1994 Base Of $60,600 Multiplied By The Ratio Of The National Average Wage Index For 2022 To That For.

The wage base or earnings limit for the 6.2% social security tax rises every year.

The 2024 Limit Is $168,600, Up From $160,200 In 2023.

The social security administration recently announced that the wage base for computing social security tax will increase to $168,600 for 2024 (up from $160,200 for 2023).

Social Security Wage Base 2024 Formulary Images References :

Source: eddieqcaroljean.pages.dev

Source: eddieqcaroljean.pages.dev

Social Security Wage Base Limit 2024 Chart Tiff Doloritas, The internal revenue service has announced an increase in the social security wage base to $168,600, up from $160,000. We determine the pia by.

Source: rosiejessamyn.pages.dev

Source: rosiejessamyn.pages.dev

Social Security Wage Limit 2024 Explained Halie Leonora, The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600. Social security wage base for 2024.

Source: amybanabella.pages.dev

Source: amybanabella.pages.dev

Maximum Social Security Benefit 2024 Increase Van Lilian, This change affects how much of your income is subject to social security taxes. The social security administration (ssa) recently announced that individual taxable earnings of up to $168,600 annually will be subject to social security tax in 2024.

Source: kamilawsally.pages.dev

Source: kamilawsally.pages.dev

Maximum For Ssdi 2024 Lolly Rachele, Typically the pia is a function of average indexed monthly earnings (aime). The wage base or earnings limit for the 6.2% social security tax rises every year.

Source: myrtababigael.pages.dev

Source: myrtababigael.pages.dev

200 Social Security Increase 2024 Calculator Alfy Louisa, After an employee earns above the annual wage base, do not withhold money for social security taxes. The 2024 social security wage base is $168,600, up from the 2023 limit of $160,200.

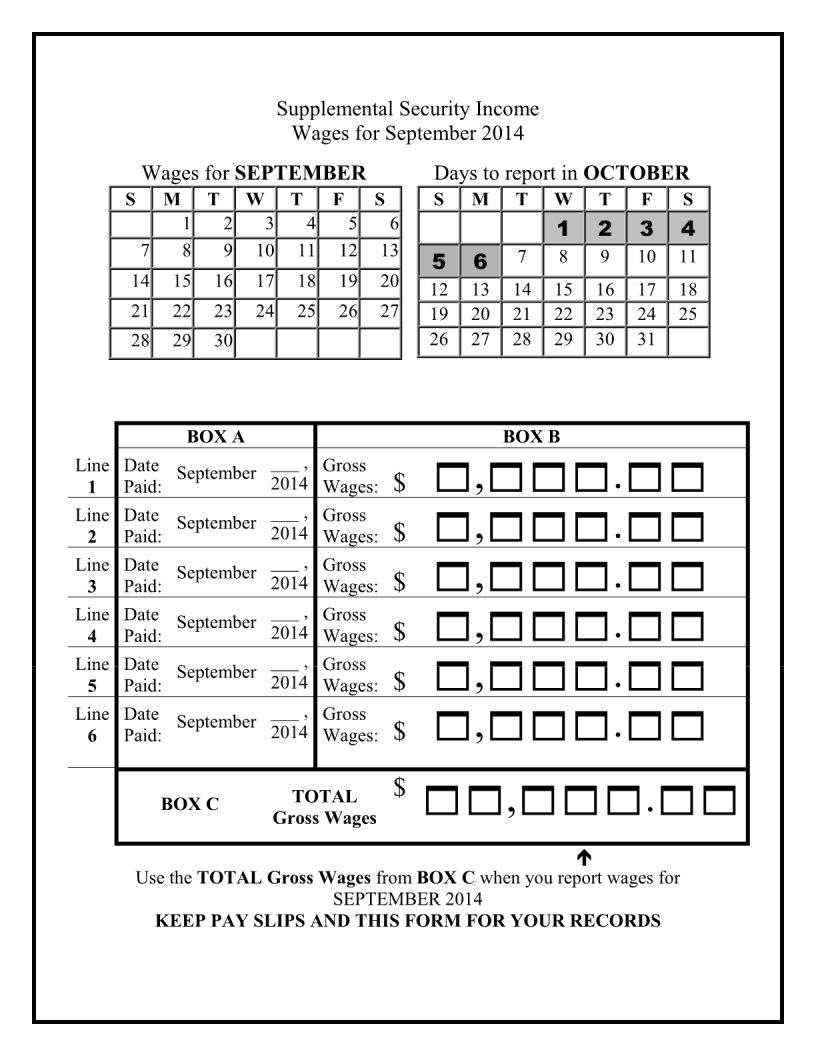

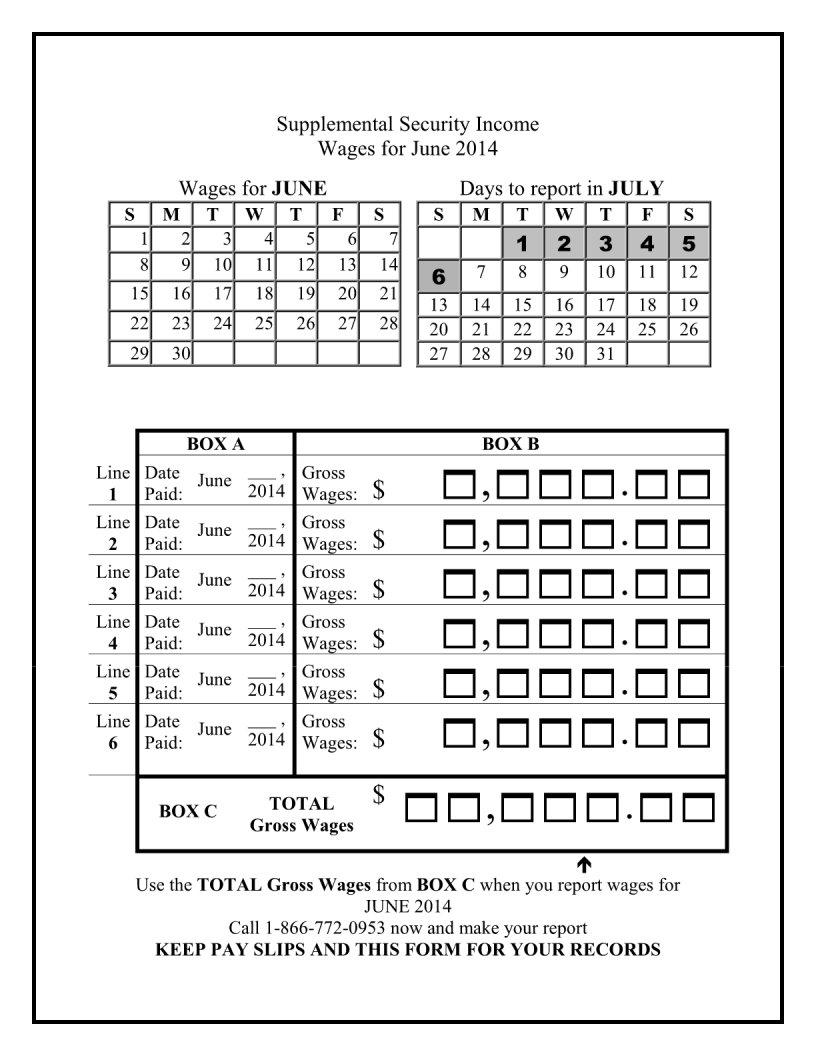

Source: formspal.com

Source: formspal.com

Social Security Wage Form ≡ Fill Out Printable PDF Forms Online, The internal revenue service has announced an increase in the social security wage base to $168,600, up from $160,000. This change affects how much of your income is subject to social security taxes.

Source: ninasherrie.pages.dev

Source: ninasherrie.pages.dev

Social Security Max 2024 Wages Cleo Mellie, For 2024, the maximum social security tax that an employee will pay is $10,453 ($168,600 x 6.2%). Base for 2024 under the above formula, the base for 2024 shall be the 1994 base of $60,600 multiplied by the ratio of the national average wage index for 2022 to that for.

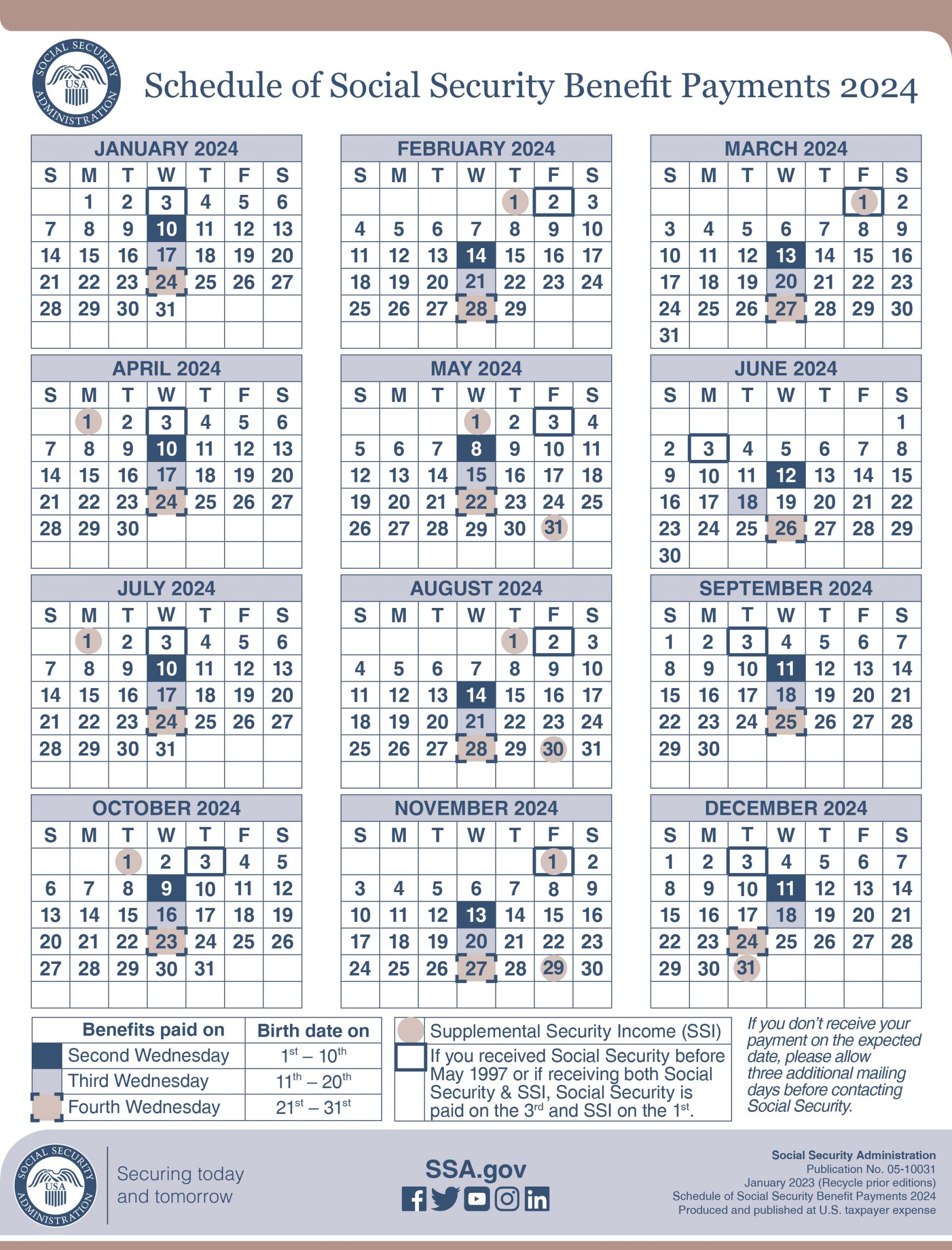

Source: rozaliewkiele.pages.dev

Source: rozaliewkiele.pages.dev

2024 Social Security Pay Chart Katha Maurene, We call this annual limit the contribution and benefit base. Social security wage base for 2024.

Source: formspal.com

Source: formspal.com

Social Security Wage Form ≡ Fill Out Printable PDF Forms Online, The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600. Summary of changes coming in 2024.

Source: www.merlineandmeacham.com

Source: www.merlineandmeacham.com

The Social Security wage base for employees and selfemployed people is, Let's break down what this. After an employee earns above the annual wage base, do not withhold money for social security taxes.

The Basic Social Security Benefit Is Called The Primary Insurance Amount (Pia).

Typically the pia is a function of average indexed monthly earnings (aime).

The Social Security Administration Recently Announced That The Wage Base For Computing Social Security Tax Will Increase To $168,600 For 2024 (Up From $160,200 For 2023).

This limit changes each year with changes in the national average wage index.

Posted in 2024